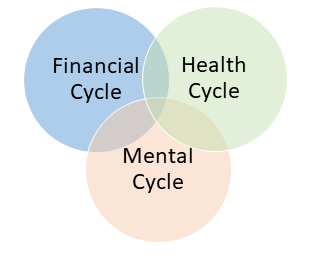

How Link Between Financial, Physical And Mental Health Circles Impacting Personal Life and How to Break it.

What is stress ? and how it is affecting the Human Body?

Stress is the Human body’s response to any demand made on it. It affects almost every system of the body, including heartbeat, breath, muscles and our brains. A little stress can be a good , if it motivates us to respond constructively to a threat or opportunity .Stress resulting from financial challenges is often chronic, affecting almost 25% of Humans Unexpected expenses, Sudden Health Care Expenses or the need to save for retirement have major impact on[NN(1] life.

Stress Circle No. 1: Physical Health Cycle

Physical health issues are linked to Chronic stress. High stress causes a make or break reactions, releasing adrenaline and cortisol and these hormones suppresses immune, digestive, sleep and reproductive systems, the continuous stress may cause them function normally to stop working.

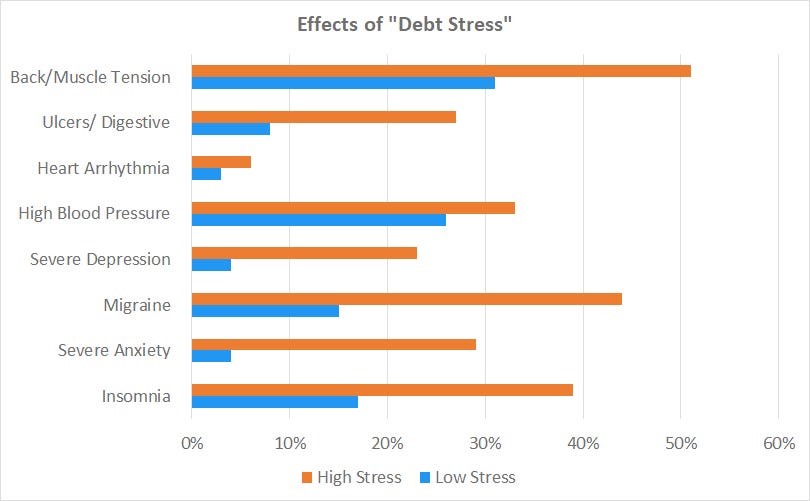

As per research Employees with high financial stress likely to report poor health and Most of them are more than four times as likely to complain of headaches, depression, or other ailments. The chart from the research shows how much sicker people with “debt stress” .

Normally, Financial stress is associated with health challenges.

Stress is also associated with high-risk behavior including alcohol and drug abuse; overeating, sedentary behaviors like web surfing and TV watching. These behaviors can worsen one’s health and finances.

Poor health can worsen money challenges and financial stress by increasing medical expenses, reducing productivity at work and making it harder to make good financial and medical decisions:

The potential financial challenges leading to poor health, directly and indirectly via unhealthy behaviors.

Hence Financial stress associated with high-risk behaviors and poor health, which again worsen financial stress.

Stress circle No. 2: Delayed Healthcare treatments

Financial stress can also harm health when lack of financial resources causes people to delay necessary medical treatment. Mostly seen that Dental or Eye treatments or general medical symptoms are normally ignored by people who normally under financial stress or Pressure.

Almost 25 to 50% has trouble paying medical bills, causing delaying treatment. Cost-related concerns may be most important for people with chronic conditions such as high blood pressure, asthma and diabetes.

More than 60 percent of people with common chronic diseases have missed medication because of cost.

This leads to the additional cyclic medical condition which results in unexpectedly high out of pocket costs, increasing stress, This again worsens the condition directly and indirectly as the patient delays needed medical care and medication.

This Cycle may become more widespread as more expensive the medical treatments become.

Stress Circle No. 3: Mental Health Cycle

we experience financial stress mentally as well as physically. People with higher debt are 60% more likely to have a mental health issue, especially depression, anxiety and psychotic disorders.

Most common cause of suicide is Financial stress, after depression.

Humiliation of being the financially stressed makes it harder to seek help which in turn worsens mental health.

Mental health challenges can impact decision making, self-control as well as employment possibilities.

Those with dealing with scarcity suffer from greater loads involving conscious intellectual activity (such as thinking, reasoning, or remembering) This leads to decision making by limited means work, This also affects impairing executive functioning including creativity, empathy, planning for the future and problem-solving.

How can we Break the Chain

Individuals can take steps to improve their financial behaviors, by better controlling spending and increasing savings. This begins with

- Planning for one’s future and creating a budget designed to make you happier.

- Others may benefit from the advice of a financial advisor or credit counselor.

- We can also work on developing money habits

- Exercising, using relaxation techniques such as yoga and meditation, and obtaining support from friends, family and, perhaps, a therapist.

All the Financially aware people along with Governments, healthcare providers and businesses have a moral responsibility and a direct interest in breaking these loops which destroy welfare, social capital and shareholder value. They should sponsor financial wellness programs along with general and mental Awareness Programs to help people control their spending, attain resiliency with emergency funds, and plan for the future.

Financial institutions need to support such programs and provide products and services more appropriate to low and middle-income consumers.

In short,

The Most of the Middle class is stressed because they lives paycheck-to-paycheck, saves nothing for retirement, has little financial literacy and is increasingly being asked to shoulder the costs and uncertainties of healthcare and retirement. The resulting stress can cause physical and mental health to spiral along with financial health.

It’s time we do something about it.

That is the reason I have created a Mission to reach to 100K Families in my lifetime to Build a Powerful structures around Wealth, Health, Happiness & Spirituality.

My Motto is “ Live Life Powerfully , Live Life You Love”

If you resonate with my vision and Mission and want to Join the Community of Like Minded for Building our stress free Life by achieving most of our Goals in Life.

You can Build the mindset required to build , Learn Tools and Techniques & create Implementation Plans/checklists.

Join My 90 Minute Free Webinar to Know more and get attached to My Mission.

Webinar-Website1 | Prosperitylifestylehub (dotcompal.co)

Regards,

Nitin Narkhede

Founder – Prosperity Lifestyle Hub.